The State of TON DeFi Q3 2023

TLDR:

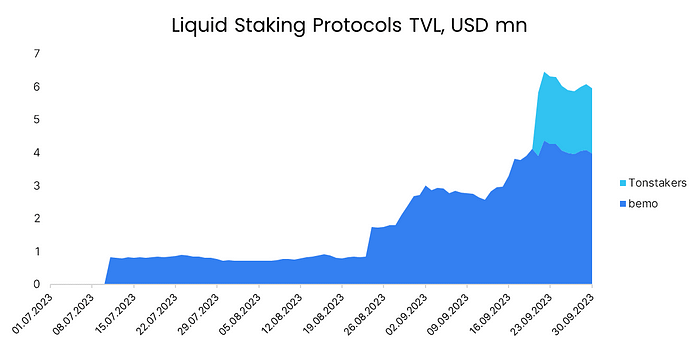

- The launch and rapid growth of liquid staking protocols, such as bemo and Tonstakers, are mitigating the decline in TON TVL following the end of the Liquidity Mining Campaign. Notably, both Tonstakers and bemo currently hold the top positions by TVL in TON, with the latter also making an appearance in CryptoRank’s “Top-10 Liquid Staking Projects by 30D TVL Growth.”

- STON.fi launched the first farming program in TON Ecosystem.

- The official TON-Ethereum bridge now supports transfers of all ERC-20 standard tokens to and from TON Blockchain and supports Wallet Connect.

- DAOLama, an NFT lending platform, and TonUP, a launchpad, are two new projects that were launched on TON this quarter.

- The unveiling of Wallet in Telegram and TON’s role in building Telegram’s Web3 ecosystem are positioning TON’s DeFi as the ultimate decentralized alternative to traditional banking.

This public article is the result of an internal report conducted by The Open Platform.

Accelerating Blockchain Startups to Escape Velocity. https://top.co/

As always, we continue to highlight key developments within each DeFi segment, unveil new projects, and outline the trajectory of TON’s DeFi ecosystem.

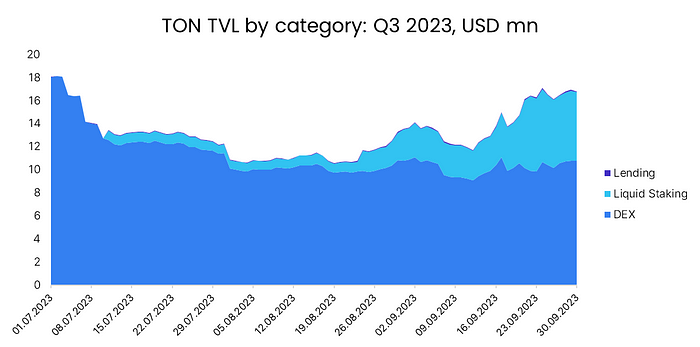

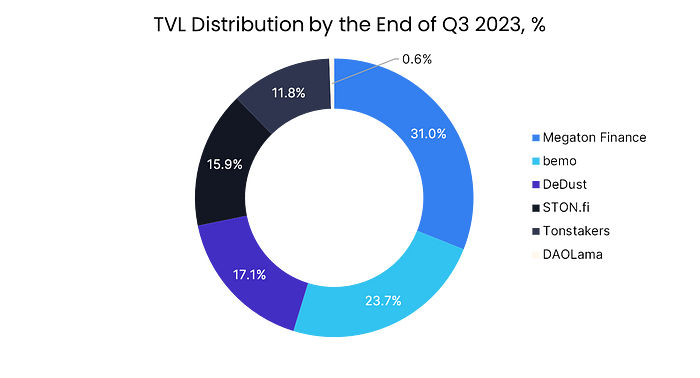

The standout DeFi development on TON this quarter is the notable surge in liquid staking, underscoring the growing demand for flexible capital efficiency tools within the ecosystem. This brought about a significant change in TON’s TVL distribution, previously dominated solely by DEXs.

Other components of the ecosystem also significantly contributed to its expansion and maturation. DEXs, with STON.fi, DeDust, and Megaton Finance at the forefront, have remained focal points within TON Ecosystem, driving adoption and user engagement through the introduction of new features and incentives. Concurrently, launchpads like GAGARIN, Tonstarter, and the newcomer TonUP have been pivotal in supporting new projects. Lending protocols have continued to expand their collateral and borrow options while introducing new lending features to meet the dynamic needs of users. Additionally, the latest update of the official TON Bridge demonstrates the efforts directed towards achieving cross-chain interoperability, which will complement future EVM capabilities when they are introduced to TON.

Overview

TON Ecosystem received a lot of attention this quarter, resulting in a surge in market cap, as well as a strong increase in the number of wallets.

Following the conclusion of the Liquidity Mining Campaign, there was a decline in TON’s TVL until the middle of the quarter. However, an increase in activity on liquid staking protocols, coupled with the launch of Tonstakers, facilitated a rapid recovery of TVL by the end of the quarter:

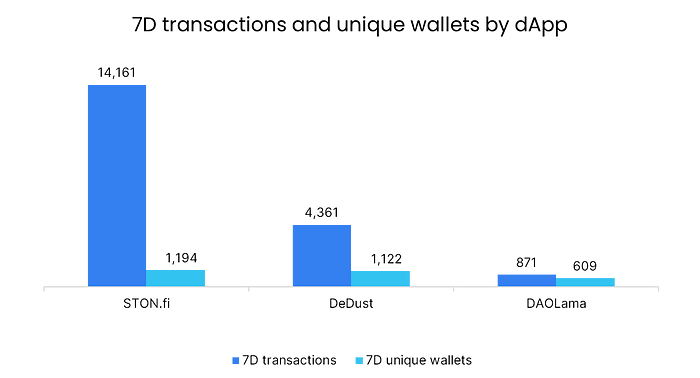

Two of the three major DEXs on TON have the highest user activity among all DeFi dApps:

Liquid staking protocols, including bemo and Tonstakers, contributed to more than 35% of TON’s TVL by the end of Q3 2023:

At the time of this report, the share of TVL contributed by liquid staking protocols continues to rise. Notably, Tonstakers and bemo currently hold the top positions with a TVL of $13.73M and $8.96M respectively.

DEX Projects

The Liquidity Mining Rewards Campaign has now closed. However, token holders in TON Ecosystem are still able to earn attractive passive yields.

STON.fi has launched the inaugural farming program in TON Ecosystem, which allows users to stake their LP tokens and earn rewards. The pools are currently paused and not accepting further deposits. Read more about farming pools on TON and check out STON Farms to stay updated on the availability of pools.

DeDust has introduced a routing feature, streamlining asset swaps that lack a designated pair into a single click. This feature not only makes trading more efficient, but also introduces new pairs for liquidity providers, increasing the number of earning opportunities. You can read more about routing here. DeDust is now officially listed on CoinGecko. You can use CoinGecko to monitor the DEX’s overall trading volume and the volume of individual trading pairs.

Storm Trade completed Testnet 2.0 and the Early Birds program, where participants claimed 30,000 STORM. Storm Trade launched its mainnet in late October, which features the Telegram trading bot in addition to the usual web trading interface.

Megaton Finance has unveiled its first roadmap, which outlines a future ecosystem that reaches far beyond DeFi. The roadmap includes the following projects: T@connect, a non-custodial wallet based on a Telegram chatbot developed by Ozys, the team behind Megaton Finance; MEGA Game Zone, a GameFi platform; Leaderboard Stadium, a dashboard showcasing the top Megaton farmers; and MEGA Financial District, a comprehensive financial system for professional market players.

Optus introduced analytical dashboards with real-time data, charts and trends to empower traders with insights from all TON DEXs. Previously, the project released a detailed article on the results of the demo launch that included a list of bugs that were fixed before the official launch.

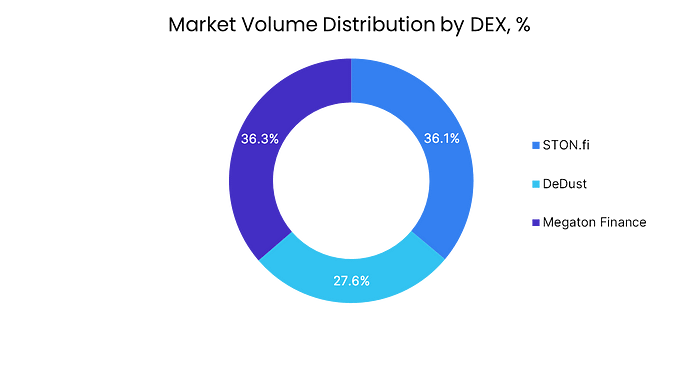

Megaton Finance, STON.fi, and DeDust account for the largest share of the trading volume on TON, with Megaton Finance leading, followed by STON.fi and then DeDust:

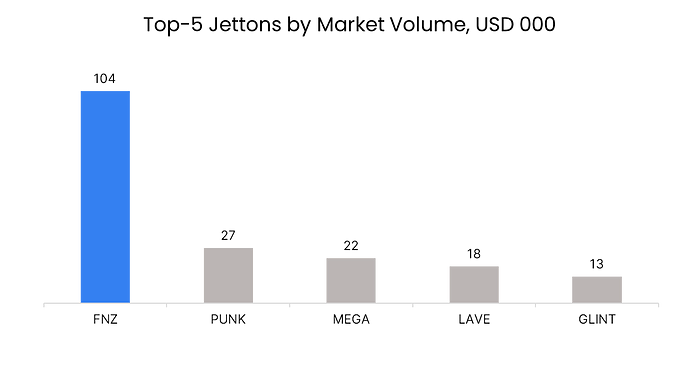

The trading volume mostly comes from tokens with real utility, including FNZ, PUNK, MEGA and GLINT (the native tokens of Fanzee, TON Punks, Megaton Finance and TON Diamonds):

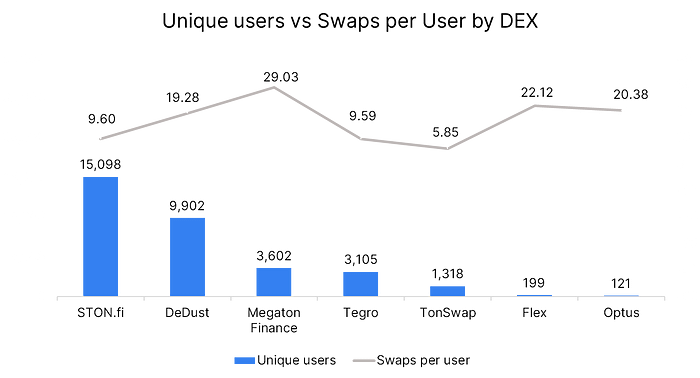

STON.fi contributes the largest share of unique users, followed by DeDust. DeDust and Megaton Finance, however, have higher trading activity per user:

Lending Protocols

Evaa Protocol has successfully concluded its angel round on Tonstarter, with active participation from TONcoin.fund. Additionally, Evaa launched the mainnet of its Beta in the early October. Participants of the mainnet’s waitlist got the chance to claim the Early Adopters Airdrop, access new lending features such as borrowing using $TON as collateral, open short and long positions on TON mainnet, and participate in the liquidity mining program. .

Tonpound announced the addition of new tokens that will be available for lending and borrowing soon. Currently, the platform supports 9 tokens, including common stablecoins, as well as wBTC, wETH, pTON, rETH, cbETH and sETH2.

DAOLama — The First NFT Lending Protocol on TON

DAOLama allows users to leverage their NFTs as collateral for borrowing Toncoin. The protocol makes it possible for users interested in temporarily owning an NFT to borrow it for a fee. This scenario is particularly relevant, for instance, when an NFT provides exclusive access to an event. Conversely, NFT lenders stand to earn interest by facilitating the temporary use of their NFTs by others. DAOLama extends its support to a variety of popular NFT collections on TON, including TON Diamonds, TON Punks, Anonymous Telegram Numbers, and TON DNS Domains.

Moreover, the service now allows NFT owners to sell their NFT while it is pledged. Once the NFT is sold, the seller receives Toncoin and their pledge is closed. Looking ahead to next quarter, the team aims to add the ability to buy NFTs with leverage as well as introduce a jettons lending protocol.

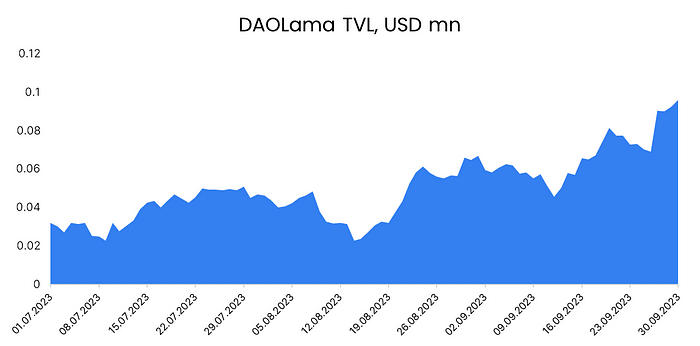

DAOLama experienced consistent growth throughout the quarter, reaching $95.91K by the end:

Staking

Liquid staking protocols demonstrated the most robust TVL dynamic over the quarter. bemo demonstrated steady growth over the period and appeared in “Top-10 Liquid Staking Projects by 30D TVL Growth”, according to CryptoRank.

Tonstakers, a new liquid staking protocol on TON, further boosted the network TVL since its launch. In August, Tonstakers released its beta. Users are welcome to learn more about the protocol in the official guide.

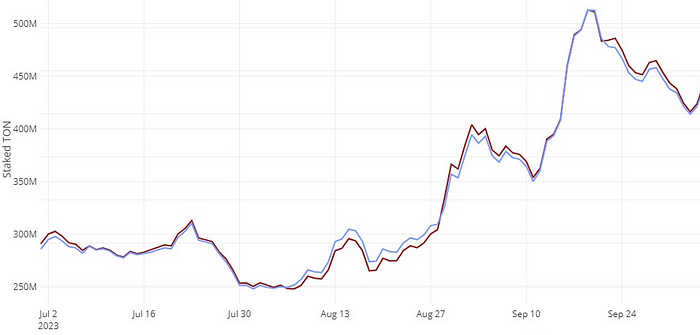

Meanwhile, the amount of staked TON reached its ATH of over $500M this quarter. The red line represents the total stake overlaid over the TON price:

Additionally, TON Foundation introduced a new liquid staking contract that is currently on the testnet and is expected to be launched on the mainnet soon.

Hipo Finance also launched its testnet and an incentive program for all participants.

Launchpads

Two of TON’s major launchpads, GAGARIN and Tonstarter, shared their fundraising and strategic updates.

GAGARIN partnered with Gotbit, a Web3 hedge fund and market maker, and secured a $115,000 funding round to support its IDO initiatives. Additionally, GAGARIN secured the 6th spot in the CryptoRank ranking by ATH ROI.

Tonstarter’s new project, Community bot, won the TWA Challenge, a contest for Telegram Web Apps developers. Community is a toolset designed to help projects, brands, companies, and content creators onboard and manage their communities. It is actively used by TON Ecosystem participants.

A new launchpad on TON was launched this quarter.

TonUP — A Gateway to Find Assets with 100x Potential on TON

TonUP Launchpad is a new platform for launching projects on TON, providing comprehensive support across all launch stages, including IDO and integration with TON DEX. TonUP has already completed a fundraising round for Tap Fantasy, an MMORPG blockchain game on BNB and Solana, now making its move to TON. The allocated 80,000 TON ($140,558) involving 167 investors is earmarked to facilitate the expansion of in-game functionality and the launch of a Telegram bot, as outlined in the project’s profile.

Bridges

The official TON-Ethereum bridge has undergone a major update. It now facilitates the transfer of all ERC-20 standard tokens to and from TON Blockchain. Previously, it only supported transfers of USDT, USDC, DAI, and wBTC.

Additionally, the bridge now supports the widely-used Web3 protocol, Wallet Connect. This means that users can now interact with the bridge using various Ethereum wallets, which significantly expands the opportunities for interaction between TON-based dApps and other ecosystems. Furthermore, the bridge is now accessible on mobile devices.

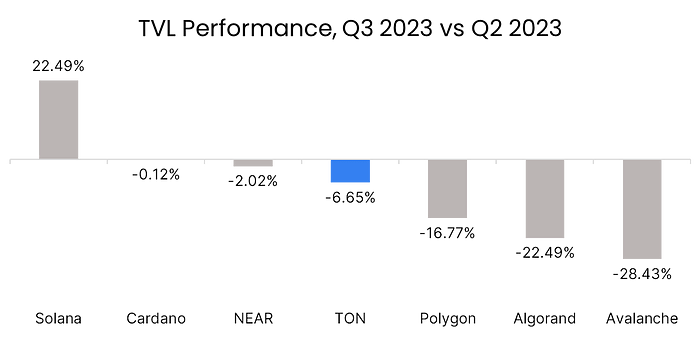

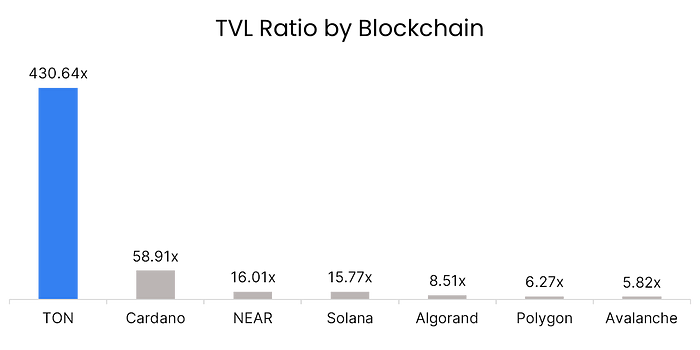

TON vs Peers

Both TON and its peers have experienced a decrease in DeFi activity. TON’s decline can be linked to reduced activity following the conclusion of the Liquidity Mining Campaign. The negative performance observed among other peers is likely due to the broader market direction, except for Solana. Solana stands out with its major liquid staking protocols, Jito and Lido, exhibiting a positive activity trend. Notably, these protocols have played a role in bolstering the Solana network TVL.

The heightened focus on TON Ecosystem can be attributed primarily to the introduction of Telegram Wallet, self-custodial wallet based on TON within the Telegram platform. Additionally, the unveiling of Telegram’s Web3 Ecosystem has played a pivotal role in sustaining TON’s valuation well above market levels.

The start of TON’s role in Telegram’s Web3 ecosystem underscores its unique position in the blockchain space, positioning it as a promising and innovative platform. This distinctiveness carries the potential to disrupt traditional financial systems, and this outlook is likely reflected in its current valuation.

Future Outlook

The significant public attention that TON received this quarter places a considerable responsibility on its community. While boosting DeFi activity remains one of our key areas of focus, TON’s growth strategy goes beyond simply replicating what other mature blockchains have already achieved in their DeFi ecosystems.

The recent launch of Wallet in Telegram and TON’s role in building Telegram’s Web3 ecosystem are positioning TON’s DeFi as the ultimate decentralized alternative to traditional banking. This has the potential to onboard unbanked individuals and offer a compelling alternative to existing financial solutions. The implication is that DeFi on TON is poised to be seamlessly integrated into the full-fledged app ecosystem of Telegram, granting access to its massive user base of 1 billion individuals.

As we move forward, our collective efforts will not only shape the future of DeFi but also contribute to a more inclusive and accessible financial landscape. TON’s mission extends beyond DeFi; it seeks to transform how people access and engage with financial services globally. With this exciting opportunity ahead, we are committed to building a decentralized ecosystem that empowers individuals and communities worldwide. Together, we are moving toward a more equitable and decentralized financial future.

In the meantime, local challenges such as the absence of EVM capabilities and oracles need to be addressed to enhance communication between TON and other blockchains and ensure data integrity within the ecosystem. We are constantly seeking builders who can help overcome these challenges or introduce new protocols to the ecosystem, in order to diversify its financial landscape.

What to build on TON now?

We look forward to seeing:

- Solutions that bring EVM capabilities to TON

- Oracles

- Synthetic asset protocols and exchanges

- A TON-native collaterized stablecoin

- Autocompounders/yield optimizers

Do you have ideas about how to bring more value and utility to our DeFi ecosystem? DM us on Twitter or visit our official website: https://top.co.